New York Withholding Tax Form – A lot of people might find themselves perplexed when it pertains to completing the Withholding Form, a essential document that identifies how much federal earnings tax is deducted from your paychecks. Comprehending this form is necessary, as it can significantly influence your net pay along with your general tax obligation at year-end. By accurately finishing your withholding, you can stay clear of owing a large sum when tax obligations are due or paying too much throughout the year, which could be better utilized in your spending plan. Allow’s walk you with everything you need to understand about this essential form. New York Withholding Tax Form.

Kinds Of Withholding Forms

Prior to you discover tax withholding, it is very important to recognize the various types of withholding forms you’ll run into. Each form serves a one-of-a-kind purpose, and recognizing which one applies to your situation can save you effort and time. Below’s a brief summary of one of the most usual kinds:

- Federal Withholding Forms

- State Withholding Forms

- Various Other Appropriate Forms

- Employer-Specific Forms

- Additional Withholding Options

This understanding will certainly aid you navigate your tax duties a lot more efficiently.

| Type | Description |

|---|---|

| Federal Withholding Forms | Forms required by the IRS to deduct federal taxes from your paycheck. |

| State Withholding Forms | Forms necessary for your state tax obligations. |

| Other Relevant Forms | Additional forms related to specific withholdings, such as local taxes. |

| Employer-Specific Forms | Forms that vary depending on your employer’s requirements. |

| Additional Withholding Options | Choices you can make regarding extra deductions from your paycheck. |

Federal Withholding Forms

Forms for federal withholding are primarily created to inform your company just how much federal income tax to hold back from your wage. The most usual form is the W-4, which you send upon starting a task or when your monetary circumstance changes. It’s crucial to finish this form accurately to prevent under-withholding or over-withholding taxes.

State Withholding Forms

For state tax obligations, each state has its very own set of withholding forms, usually imitated the federal W-4. These forms define the amount of state tax to hold back from your paycheck. If you work in numerous states or move states throughout the year, you require to readjust your withholdings as necessary to ensure conformity.

And also, recognizing your state’s particular withholding demands can substantially affect your net income. Variations in state tax prices and reductions may need you to send the proper forms to prevent charges. Failing to do so could result in unanticipated tax liabilities when you file your annual returns.

Various Other Appropriate Forms

Among the often-overlooked facets of tax withholding is the presence of other pertinent forms that might affect your finances. These might consist of forms for local taxes or unique exemptions, as well as those for sure advantages. Each of these forms can play a important duty in accurately reflecting your tax circumstance.

With a detailed understanding of withholding forms, you can take control of your tax scenario and make certain that you are certified with your federal and state responsibilities. This essential understanding will not only assist you stay clear of possible penalties but also enhance your monetary planning throughout the year.

Tips for Completing Withholding Forms

If you’re looking to guarantee the accuracy of your tax withholding, there are a number of suggestions you can adhere to when finishing your withholding forms. Below are some critical methods to keep in mind:

- Understand Your Tax Situation to make informed decisions.

- Double-Check Info for mistakes or inaccuracies.

- Look For Expert Aid if you’re uncertain about your forms.

Perceiving the significance of these steps can substantially affect your tax obligations.

Recognizing Your Tax Circumstance

Forms are not one-size-fits-all. You require to evaluate your tax situation to determine what withholding amount will fit your certain demands. Elements such as revenue degree, marital condition, and dependents all play a vital role in just how much tax you must withhold. Knowing these components will certainly aid you complete the appropriate forms accurately.

Double-Checking Information

Even small blunders can result in substantial tax problems. When you finish your withholding forms, it’s vital to meticulously examine all info you have actually gone into. Make sure that your Social Security number, address, and various other personal details are correct. A minor error can result in hold-ups and possible charges.

Your diligence in double-checking can save you from future migraines. Pay certain interest to entrances related to your declaring status and the variety of allocations you claim, as these can greatly affect your tax worry. Correcting an error after submission can be a hassle, so it’s much better to invest the time ahead of time to validate everything is accurate.

Seeking Expert Aid

Aid is vital if you’re feeling unsure regarding exactly how to finish your withholding forms. Consulting with a tax specialist can supply you with customized advice and help navigate the details of tax laws that refer to your personal scenario.

One more advantage of looking for specialist aid is their competence can lead you in taking full advantage of deductions and credit histories, eventually decreasing your overall tax responsibility. They can also assist in ensuring that you are withholding the proper quantity, preventing overpayment or underpayment, both of which can have serious financial consequences. Involving with a professional may feel like an added expense, however the long-lasting financial savings can be significant.

Step-by-Step Overview to Completing Withholding Forms

Unlike numerous other forms, filling in a withholding form accurately is essential for making sure the appropriate amount of taxes is withheld from your income. A mistake in this process can result in underpayment or overpayment of taxes, leading to undesirable surprises come tax season. Below’s a uncomplicated step-by-step guide to assist you browse this important job.

Actions to Fill Out Withholding Forms

- Step 1: Collect Necessary InformationCollect personal details such as your name, Social Security number, and declaring standing.

- Step 2: Picking the Right FormDetermine which form you need based upon your work situation and choices.

- Step 3: Finishing the Form AccuratelyFill in all relevant areas, guaranteeing that information is correct and full.

- Tip 4: Sending the FormAfter conclusion, send the form to your company or the appropriate tax authority.

Gather Necessary Details

There’s no requirement to rush into filling in your withholding forms without the right details. Before you begin, gather all necessary individual info, including your complete name, Social Security number, address, and work information. This info is very important to ensure that your form is filled in properly and reflects your economic situation precisely.

Choosing the Right Form

Guide your decision by comprehending the various kinds of withholding forms offered, such as the W-4 for staff members or the W-4P for pensioners. Your choice will certainly depend on your work type and personal financial circumstance, consisting of elements like extra revenue and exemptions you might get.

The best form can dramatically influence your tax withholding amounts, so take your time to select sensibly. If you are independent or have multiple incomes, think about speaking with a tax specialist to determine which forms ideal match your demands to avoid any type of possible tax obligations.

Completing the Form Properly

Now that you have all your information and have chosen the ideal form, it’s time to fill it out. Very carefully enter all called for details, such as filing condition and exemptions. Any errors can bring about incorrect tax withholding, which could impact your economic health and wellness throughout the year.

A detailed evaluation is necessary prior to settling your form. Think about ascertaining all access for typographical errors or noninclusions. Keep in mind, each piece of details, from your marriage status to your number of dependents, plays a crucial role in determining just how much tax is held back.

Sending the Form

Little things can make a big difference when it comes to tax forms. As soon as you have actually completed your withholding form, ensure to submit it to your employer quickly. This makes sure that the right withholding begins as soon as possible to prevent any type of issues with your paycheck.

Needed steps involve either handing your form straight to your HR department or sending it online, depending on your office’s plan. Be sure to maintain a duplicate for your records, and if you don’t see changes in your paychecks right after submitting, follow up with your company to ensure whatever is on track.

Elements to Take Into Consideration When Choosing Withholding Amounts

Now, when it pertains to picking your withholding amounts, there are numerous crucial factors to take into consideration. Comprehending these can substantially impact your monetary wellness throughout the tax year and beyond:

- Your personal financial scenarios

- Changes in work standing

- Expected tax credit scores and deductions

Personal Financial Situations

You need to review your personal economic situation extensively before picking your withholding quantities. Consider your present revenue, expenses, and any dependents you may have. This examination permits you to determine just how much tax is reasonable to withhold to avoid underpayment penalties or receiving a huge refund.

Changes in Employment Status

Among one of the most considerable changes that can influence your withholding amounts is your work condition. Whether you are starting a brand-new task, changing positions, or losing a job entirely can have a straight result on your earnings and, subsequently, your tax scenario.

A change in employment status may imply a brand-new wage, adjustments in benefits, or added revenue resources, such as part-time work. Consequently, you need to change your withholding to straighten with your present financial photo. See to it to re-evaluate your withholding if you find yourself in a new task with various pay structures, or if you handle freelance job that can complicate your tax scenario.

Expected Tax Credits and Deductions

Amounts you anticipate to claim in tax credit histories and deductions can also affect your withholding decisions. If you anticipate obtaining considerable credit scores, adjusting your withholding downwards may be feasible.

Aspects such as modifications in your life scenarios like marriage, having youngsters, or getting a home frequently include prospective tax credit scores or reductions. Making best use of these can bring about substantial savings. As a result, it is essential to assess exactly how these components interact with your general tax method, as they might lower your gross income, more informing your withholding quantity. This intentional management of your tax obligations can assist you remain solvent throughout the year.

Advantages and disadvantages of Various Withholding Methods

Keep in mind that withholding methods can considerably influence your economic situation. Recognizing the benefits and drawbacks of each strategy is critical for making informed decisions concerning your tax obligations. Below is a malfunction of the benefits and drawbacks of both greater and reduced withholding techniques.

| Pros | Cons |

|---|---|

| Less risk of owing taxes at year-end | Less take-home pay throughout the year |

| Potential for a tax refund | Opportunity cost of not investing extra funds |

| Simplifies budgeting for your taxes | May result in an overpayment of taxes |

| Easier to save for large expenses | Could affect your cash flow |

| More manageable tax payments | Less flexibility in financial planning |

| Psychological comfort of having taxes pre-paid | May require adjustment of withholding if income changes |

| Fewer surprises at tax time | Potential to miss out on investment opportunities |

| Can help avoid underpayment penalties | May lead to lower immediate disposable income |

| More straightforward tax process | Less control over your money during the year |

Pros of Greater Withholding

On a greater withholding strategy, you can take pleasure in the advantage of lessening the threat of owing taxes at year-end. This approach permits you to get a potential tax reimbursement, supplying a monetary cushion that can be beneficial in times of need.

Cons of Higher Withholding

Greater withholding means you will certainly have less net pay throughout the year. This could restrict your capability to allocate funds for everyday expenditures and various other monetary goals.

It is necessary to recognize that this restriction can cause capital problems, making it tougher to take advantage of opportunities like investments or bigger purchases. Therefore, while you alleviate the threat of tax bills, you might produce obstacles in other places in your budgeting procedure.

Pros of Lower Withholding

Withholding less from your paycheck can raise your instant cash flow, permitting you to invest or designate funds to various other top priorities in your life. This strategy can give higher flexibility for managing your funds throughout the years.

A lower withholding price can equip you to maximize your financial investment possibility and emergency situation cost savings, which can enhance your long-term economic health. Nevertheless, beware, as this strategy requires disciplined budgeting to prevent overspending and tax obligations later.

Disadvantages of Lower Withholding

Any kind of approach that involves reduced withholding provides the threat of owing taxes at year-end. This can lead to sudden financial concerns if you haven’t effectively planned for your tax commitments.

Withholding less might cause unforeseen capital troubles if your tax situation shifts suddenly. Therefore, it’s critical to track your financial resources very closely and review your withholding a minimum of yearly to guarantee you’re planned for your tax responsibilities.

Summarizing

To finish up, recognizing the function and relevance of the Withholding Form is essential for handling your tax obligations efficiently. By accurately completing this form, you can make sure that the proper quantity of tax is withheld from your earnings, which can assist protect against unexpected tax expenses or refunds at the end of the year. Constantly examine your withholding standing, particularly after significant life adjustments, to keep your economic situation in check and prevent any type of shocks come tax season.

FREQUENTLY ASKED QUESTION

- Q: What is a Withholding Form?

- A: A withholding form is a document used by companies to figure out how much government earnings tax to hold back from an employee’s paycheck. The most typical withholding form is the IRS Form W-4, which staff members submit when they begin a brand-new work or when they require to change their withholding standing. The information provided on this form, including filing status and the variety of allocations asserted, aids the employer calculate the suitable total up to withhold for tax functions.

- Q: Exactly how do I know if I require to submit a new Withholding Form?

- A: You need to take into consideration submitting a new withholding form if you experience modifications in your monetary situation that could influence your tax obligation. This can consist of modifications like marital relationship, separation, the birth of a youngster, or adjustments in your earnings. It’s additionally suggested to update your withholding if you find that you owe a considerable quantity throughout tax season or if you get a big tax reimbursement, as this suggests that your withholding could be adapted to better fit your tax scenario for the following year.

- Q: What happens if I do not send a Withholding Form?

- A: If you do not send a withholding form to your employer, they will fail to the internal revenue service specs for withholding. Generally, this indicates that the employer will certainly withhold tax obligations as if you are a single filer with zero allocations. This could lead to higher taxes being extracted from your paycheck than needed, leading to a smaller net earnings and potentially a bigger refund, but you might miss out on having even more money in your pocket throughout the year. It’s normally best to submit your withholding form to mirror your specific economic situation.

Gallery of New York Withholding Tax Form

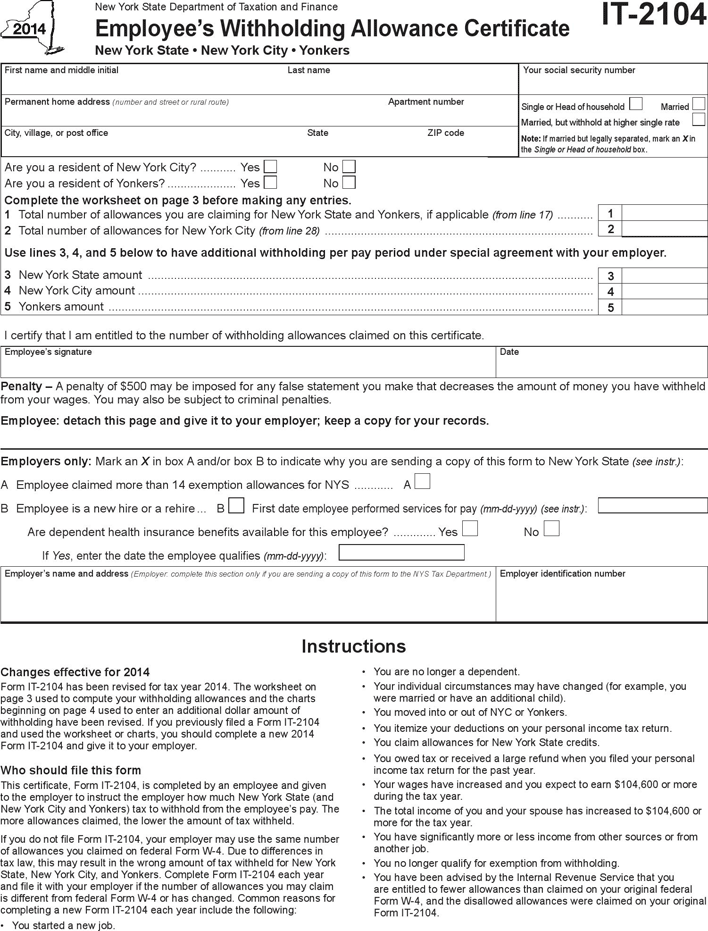

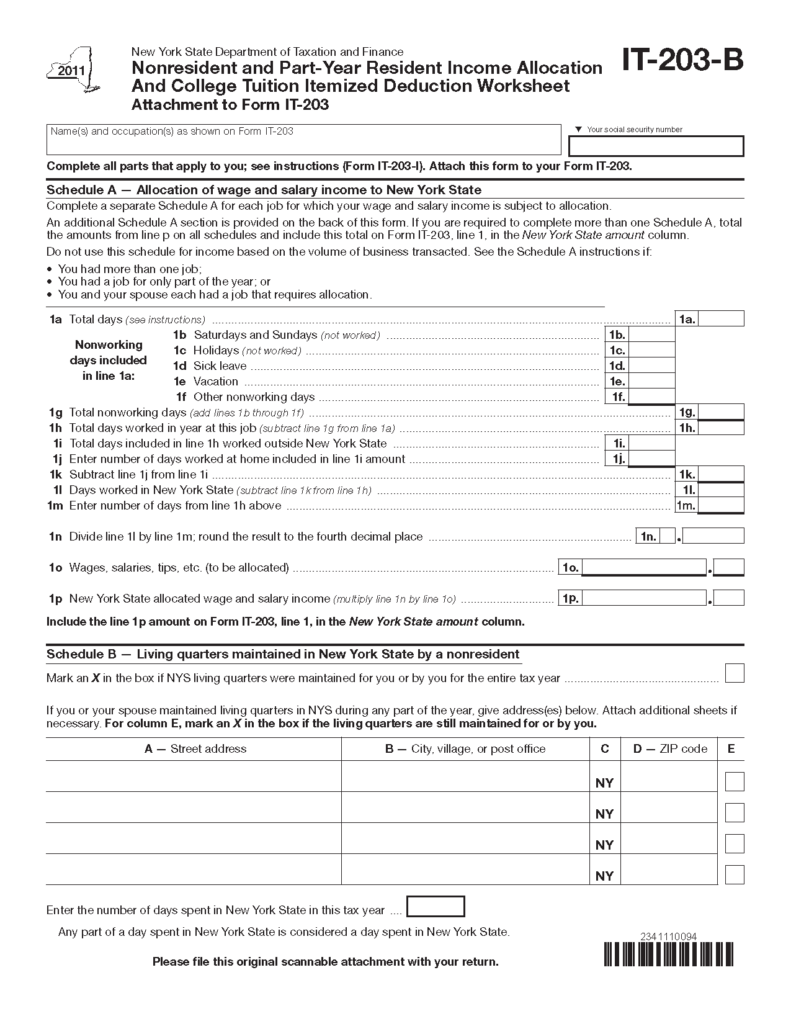

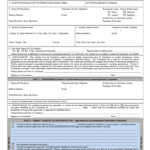

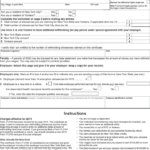

New York City Part Year Resident Tax Withholding Form WithholdingForm

New York State Withholding Tax Form 2022 WithholdingForm

Free NY IT 2104 Employee s Withholding Allowance Form PDF 516KB 7